As the third-quarter earnings season kicks into gear, Wall Street is watching for standout performances that could defy consensus expectations.

Morgan Stanley has spotlighted a trio of overweight-rated stocks – Reddit, Capital One Financial, and Roblox – that it believes are primed to deliver upside surprises.

The investors who are looking to invest $10K or more right now must take notice, as each of these companies is set to report results in the coming weeks, and analysts are already revising targets upward in anticipation of stronger-than-expected profitability.

Reddit Inc (NYSE: RDDT)

Reddit is emerging as a serious contender in the digital advertising space – with its earnings report scheduled for October 27th.

The social media stock has more than doubled since early April, reflecting investor confidence in its monetization strategy.

Oppenheimer analyst Jason Helfstein recently lifted his price target to $300, citing RDDT’s ability to capture a growing share of the $250 billion ad market outside of Google and Meta.

“Early monetization efforts have been successful,” Helfstein noted, pointing to rising impressions and stable pricing.

With over 2 billion posts and 20 billion comments, Reddit’s content depth is fueling engagement – and potentially, earnings upside.

The consensus rating on Reddit stock also currently sits at “overweight” with the mean target of about $227, indicating potential upside of another 13% from here.

Capital One Financial Corp (NYSE: COF)

Capital One Financial is scheduled to report on October 20th, and analysts are optimistic about its capital return strategy.

The financial services stock has rallied about 40% over the past six months, outpacing the broader market.

Barclays’ senior analyst Terry Ma recently dubbed it a top pick in consumer finance, highlighting expectations for accelerated share repurchases and a more aggressive capital return plan.

He also flagged Discover Financial’s expanding global network as a potential tailwind for Capital One’s long-term growth.

Ma’s “overweight” rating on Capital One shares comes with an upwardly revised 12-month price target of $257 – indicating potential upside of another 20% from here.

He’s convinced that COF will deliver a strong quarter and maintain momentum through the end of this year.

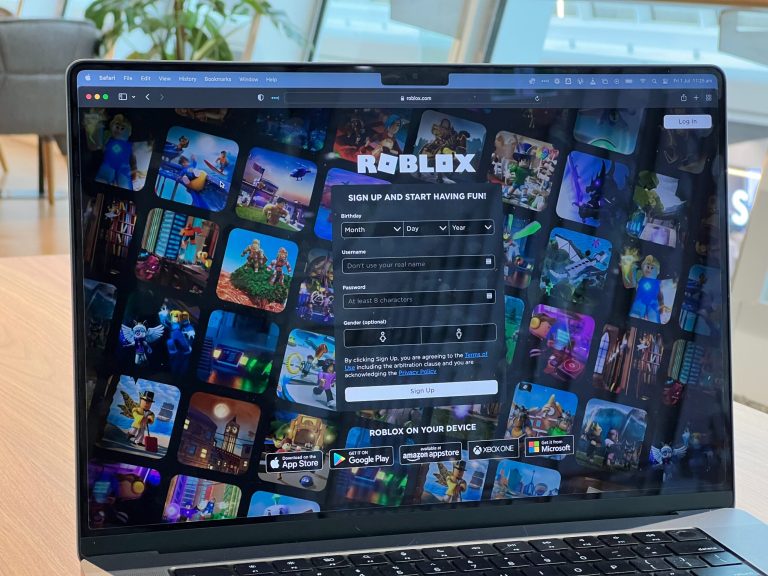

Roblox Corp (NYSE: RBLX)

Roblox, the online gaming platform, reports earnings on October 30th and has already caught the attention of Morgan Stanley and Wells Fargo.

The gaming stock has soared a whopping 140% since the first week of April – but a senior Wells Fargo analyst, Ken Gawrelski, expects it to climb further to $155.

He sees the firm’s entry into advertising as a major growth lever. “We see material upside potential to current Street estimates for both bookings and EBITDA,” – Gawrelski told clients in his latest research note.

The Wells Fargo analyst forecast notable ad revenue contributions in Q3. With momentum building and expectations rising, RBLX stock could deliver one of the season’s most remarkable earnings surprises in the third quarter.

The post These 3 stocks are poised for big earnings surprises in Q3 appeared first on Invezz